It should be a last-resort solution after all other negotiation avenues and CRM strategies have failed. Once your client signs the proposal, it becomes a legally binding agreement that protects both parties. If any billing dispute arises, this document can be referenced as a source of truth to resolve the issue. Choose the method that best reflects the value you offer and aligns with client expectations—it’s all about building trust and transparency. For instance, you can scan an image of it to your bank for a quick direct deposit. Otherwise, you’ll have to wait for it in the mail and then take it to your bank to cash it.

Over 85% of the top 100 US accounting firms partner with BILL.*

This can be advantageous if the scope of the work is uncertain or if there are frequent changes and revisions. However, it requires accurate time tracking and may lead to disputes if the client questions the number of hours billed. Invoicing and CRM templates are the unsung heroes for many startups and small business owners. They https://www.online-accounting.net/ promise consistency and accuracy of invoices while adding structure to your billing journey. Old-school timekeeping methods, such as maintaining timesheets or spreadsheets, often lead to billing errors and inconsistencies due to their extensive nature. Tracking billable hours through a dedicated app is a more sensible solution.

How to Bill a Client: Professional Ways to Handle the Billing Process

Many freelancers (like web developers and graphic artists) require deposits because of the time that passes between starting and completing a project. Explaining the reasons you are asking for a deposit can help build trust with your client. But even those who work for themselves will find it necessary to set up some systems, and an invoicing system for getting paid is perhaps the most important. Most of the time a late payment is a mistake, not something deliberate, so send a friendly reminder together with another copy of the invoice just in case it got lost on the way. If you have to deal with someone who keeps avoiding having to pay, be polite but firm.

Protect yourself with a written contract

In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy, Cookie Policy, and Consumer Health Data Notice. It’s a good idea to include the payment due date right below the date the invoice was prepared so that your client readily sees it.

What does client billing mean?

When everything is ready to go, you can click on “Send invoice” and the invoice will be sent via email to your client. If a client is eager to work with you, your proposal can be a simple email. But if you know your client is “shopping around” and you want to stand out, it’s worth putting in some extra work that gives your client a good first impression about you. Maybe you built your network, put yourself out there on a service marketplace, or did some good old-fashioned cold email outreach.

- Traditional options include mailing a physical copy or sending the invoice via email.

- It’s not enough just to send your invoice to the right company — you need the right individual.

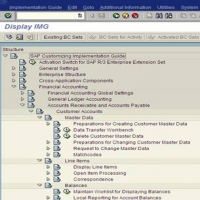

- Business owners must monitor the accounts payable balance and use a cash forecast to plan the payments.

- Your invoicing method could impact your customer relationships and ultimately how well you retain customers.

Don’t Be Too Shy to Follow Up

You can either send a friendly reminder email or a message to the client reminding them that payment is due. Don’t forget to be clear and specific about the amount owed, the due date, and the payment methods accepted. If the client has any questions or concerns about the payment process, offer help and provide a deadline for payment to encourage the client to act asap.

An invoice filled with errors or unclear components will not only slow down your cash inflow but may also be perceived as sloppy and unprofessional by your client. This includes setting an agreement/contract in writing, establishing fair penalties and late fees, or even holding back delivering projects to a client that frequently a beginner’s guide to retained earnings pays late. As for billing clients, there always seems to be mixed reviews on how to manage their invoices. We find that 27% of small and mid-sized businesses struggle with creating and sending invoices. Implementing an organized billing system saves you precious time that you can devote to your creative work.

Exchange rates, taxes, and other fees will likely all play a role when invoicing international clients. Avoid any surprises by discussing the topic at the same time that you clarify payment expectations during the client onboarding process. I personally use Copilot’s billing app to manage all of my invoices and payment methods. And while it may sound biased because I’m writing this on the Copilot blog, I am a customer of Copilot (not an employee). In the early stages of my service business, I used to manually create invoices using an invoice generator and create a folder on my computer to store all of them. While this worked for a while, as my client base grew, this method became time-consuming, and the risk of errors increased.

If you don’t receive payment from a client by the invoice due date, you’ll have to reach out directly to the client about the overdue payment and charge late fees, if applicable. It’s a good idea to offer several payment options (check, credit card, payment services like PayPal, and so on), to learn your client’s preferences, and accommodate them when possible. This also means that you’ll need to send out invoices to meet that payment “cycle.” Do they only send out payments once a month? Are they open to invoices at any time – or after each project or milestone completion? Know if it’s OK to send freelance invoices as work progresses and how they feel about being billed multiple times in a pay cycle. Do not reinvent the wheel, use an invoice generator tool to build your invoices and rely on a library of your services for your pricing.

If you’ve created your invoice in a word document, you’ll want to save it to a PDF format before sending so that it can’t be altered. Use a separate line for each type of product or service and itemize the price per unit/service/hour as well as the total price, to avoid misunderstandings. If you have other documentation, like a quote or estimate, a purchase order you received, or a contract, include that along with the invoice. This is an invoice that you send before the customer confirms their order, to give an estimate of the final price and help them make a decision.

Some of the platforms it partners with include Mollie, WePay, Stripe, and PayPal. By using an automated invoicing platform, you’re making it easier for your clients to pay you. Now, you can’t expect to get paid by your clients if you’re not giving them options to easily pay you. Then there are those who struggle with the entire process and end up waiting forever for certain clients to pay. For instance, in the UK, small businesses spend an average of 71 days waiting for payment.

If you’re doing this manually, you can find a free invoice template online. Lots of companies process all their international payments on the same day of the month. International payments take longer to clear than domestic payments, especially if there’s a currency conversion involved. Make sure to send your international invoices a few days before their payment date.

For example, always send invoices as soon as you complete a project, as soon as the shipment departs, or on the same date every month. This helps you avoid forgetting an invoice, and helps your regular customers to know when to expect it to arrive. That means including your logo and changing the font and/or color choices to match your brand’s color scheme and look. With most invoice builders, you’ll only need to do this once, and then you can save it as a new invoice template. Sending your invoice at the right time makes it more likely that you’ll get paid quickly.

Implementing a follow-up system is essential for managing these situations effectively. Consider sending gentle reminders to your clients as soon as a payment becomes overdue, and escalate your follow-up efforts as necessary. Furthermore, utilizing online payment platforms can enhance the professionalism of your business. By offering https://www.accountingcoaching.online/relevant-cost-of-labor/ clients the option to pay electronically, you demonstrate that you are technologically savvy and up-to-date with industry trends. This can help build trust and credibility with your clients, potentially leading to repeat business and referrals. Furthermore, it’s important to maintain accurate records of your billing activities.

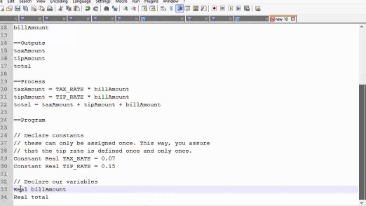

If the scope of the project has expanded or if you’re taking on additional tasks, it’s perfectly reasonable to ask for more money. Read on to see the five required steps to getting paid promptly from your freelance clients. Accounts payable may not be the most popular topic to ask questions on, but there are definitely questions floating around that need to be addressed. We’ve tracked down a few frequently asked ones and are ready to deliver the best answers below. In addition to managing paperwork, the AP department needs to post accounting entries.