Liabilities are similarly divided into current (debts due within a year) and long-term obligations. Owner’s equity represents the farmer’s stake in the farm after liabilities are subtracted from assets. This statement is crucial for understanding the liquidity and solvency of the farm, which are indicators of its ability to meet short-term obligations and to sustain operations in the long run, respectively. EasyFarm is an easy farm accounting software that stands out as a farm record keeping software for farmers with medium to small farms. The core principles of farm accounting include accurate bookkeeping of all farming transactions and understanding depreciation and amortization of assets.

- Inventory valuation is a critical aspect of farm accounting, as it determines the value of unsold crops or livestock on hand at the end of an accounting period.

- Proper reporting of these payments is essential to avoid underpayment penalties and ensure compliance with tax laws.

- As both a financial management solution and an agriculture accounting software, NetSuite does quite a lot to harmonize and integrate erp and management solutions to everyday farm activities.

- These assets typically provide value for multiple years and are subject to depreciation, which is the process of allocating the cost of a capital asset over its useful life.

- In researching bookkeeping or bookkeeping accounting, you may come across information on accounting or find that bookkeeping and accounting are used interchangeably.

Expert Support

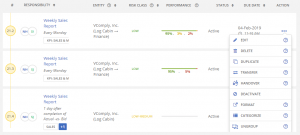

We have been able to curate a list of our top 10 farm accounting software in 2024, and this table will quickly look at what they are best for and their pricing. Sit tight as we examine the top farm accounting software that could save your farm. With the farm accountant’s guidance, farms can navigate this process more smoothly, ensuring a successful transition to the new generation of farm management. By showcasing the farm’s financial strengths, farm accountants enhance the farm’s chances of securing essential financial support.

Best Farm Accounting Software for Agricultural Bookkeeping

At the end of the course, you’ll receive a professional certificate, which you can put on your resume to demonstrate your skills and accomplishments to potential employers. Having the ability to prepare an accurate financial picture of an enterprise and keep records organized is essential for being a bookkeeper. As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, income statements, accounts receivable reports, and more.

Easy Accounting Built For Farmers

Typically, single entry bookkeeping is suitable for keeping track of cash, taxable income, and tax deductible expenses. Bookkeeping is the process of keeping track of a business’s financial transactions. These services include recording what money comes into and flows out of a business, such ten ratios for financial statement analysis as payments from customers and payments made to vendors. While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software. It can be recorded as inventory, but require inventory tracking at the end of each accounting period.

What is your current financial priority?

Budgeting and cash flow management are crucial elements of successful farm operations. Farm accountants lend their expertise in crafting detailed budgets that project future income and expenses. An accountant can certainly perform bookkeeping tasks, but the title generally involves other responsibilities as well. An accountant may interpret the financial records that a bookkeeper compiles, in order to assess a company’s financial health. Becoming an accountant usually requires more training and education than bookkeeping and can be a good next step in your financial career.

What skills do you need to become a bookkeeper?

At the same time, they devise cash flow management strategies to ensure the farm can meet its financial obligations while maintaining financial resilience in unexpected circumstances. A thorough understanding of depreciation and amortization concepts is also crucial in farm accounting. Their broad understanding of the financial intricacies of farming operations makes them a vital partner for farmers, ensuring the financial health and sustainability of the farm. “It is a fairly easy and straightforward approach, and allows an appraiser to adjust a value based on soil properties — sand, silt and clay content — location and market trends,” he says.

Their guidance, anchored in a deep understanding of financial analysis, illuminates the path to profitability and sustainability for farming operations. “In some places, it creates little financial incentive for a farmer to invest resources in practices that increase soil health,” he adds. These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge https://www.kelleysbookkeeping.com/ and skills. For example, you might complete the Intuit Bookkeeping Professional Certificate or several other bookkeeping courses offered by universities and companies on Coursera. Integrity and trustworthiness are important qualities to cultivate as a bookkeeper. Keep an organization’s financial data confidential and be transparent about your bookkeeping activities.

“The problem is that it does not account for soil health as a differentiator when assigning value to plot of land. A study looks at an alternative way of appraising https://www.quick-bookkeeping.net/calculating-the-issue-price-of-a-bond-using-the/ land based on soil health practices. In this article, you’ll learn more about what bookkeepers do, why they’re important to a business, and how much they earn.

You’ll also explore how to become one and find suggested cost-effective courses that can help you gain job-relevant skills today. Bookkeepers manage a company’s financial accounts, ensuring they are accurate and easy to review. Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year. According to 81 percent of CBs who interviewed for a new job after becoming certified, having a certification contributed to getting the interview [4].

Solvency ratios, including the debt-to-asset ratio and the equity-to-asset ratio, provide insights into the farm’s long-term financial stability and its capacity to withstand adverse economic conditions. Profitability ratios, such as the return on assets and the net profit margin, measure the farm’s ability to generate earnings relative to its sales, assets, or equity. These ratios can reveal the effectiveness of the farm’s management practices and its overall financial performance. The balance sheet is a snapshot of a farm’s financial condition at a specific point in time. It lists the farm’s assets, liabilities, and owner’s equity, offering a comprehensive view of what the farm owns and owes. Assets are typically categorized as current (cash or assets that can be converted into cash within a year) or non-current (long-term assets like land and equipment).

Farm accountants are skilled in establishing comprehensive record-keeping systems that accurately track and report all income and expenses. In its report, the institute claims there are no market drivers to really retain the premium of farmland under soil health-focused management. Bookkeeping is a crucial function of accounting, and earning a bookkeeping certification is a great way to show employers your expertise.

Farm accounting is underpinned by a set of core principles that guide the recording and analysis of financial data. These principles ensure that the financial information is reflective of the farm’s actual economic activities and provides a foundation for informed financial decision-making. Understanding these principles is crucial for maintaining accurate and reliable financial records. Liquidity ratios, such as the current ratio and the quick ratio, assess a farm’s ability to meet short-term obligations without selling inventory or making other significant changes to operations.